how long can the irs legally collect back taxes

Can the IRS go back more than 10 years. Generally under IRC 6502 the IRS will have 10.

What Is The Interest Rate The Irs Charges For Back Taxes

The IRS has a 10-year statute of limitations during which they can collect back taxes.

. If you are an individual you may qualify to apply online if. This is known as the statute of. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

The IRS has a 10-year statute of limitations during which they. Long-term payment plan installment agreement. You owe 50000 or less in.

However if you are getting notices from the IRS and you are wondering if they will ever go away the answer is yes. Learn more about the IRS Statute of Limitations here. This time restriction is most commonly known as the statute of limitations.

As a general rule there is a ten year statute of limitations on IRS collections. This means that under normal circumstances the IRS can no longer pursue collections action against you if. If you are dying and your estate is worth over 3000000 the IRS can tax your estate at a rate of 40 on the value.

The collection statute expiration ends the. But the agency cant chase you forever. As a general rule there is a ten year statute of limitations on IRS collections.

Once that time expires you are free from the remaining unpaid tax debt and the IRS cannot collect from you unless they go to court and create a tax judgement which is rare. After this 10-year period or statute of limitations. Failing to pay your taxes may lead to IRS collection activities.

Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. This means that the IRS can attempt to collect your unpaid taxes for up to. Will the IRS let you make payments on back taxes.

How Long Can the IRS Collect Back Taxes. Can the IRS collect after 10 years. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

This means that the IRS cannot collect tax debts that are more. A tax assessment determines how much you owe. How Long Does The IRS Have To Collect Back Taxes.

445 71 votes. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. The IRS 10 year window to collect.

IRS Direct Pay IRS Direct Pay is free and available at IRSgovDirectPay where you can securely pay your taxes directly from your checking or. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. The Internal Revenue Service has a 10-year statute of limitations on tax collection.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. This means that the IRS can attempt to collect your unpaid. The IRS generally has 10 years from the date of assessment to collect on a balance due.

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. If you did not file.

The tax code allows the IRS three years to audit your tax return and 10 years to collect any tax you might owe. GET PEACE OF MIND. As already hinted at the statute of limitations on IRS debt is 10 years.

The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. Statute of Limitations on IRS Debt Collection. Secure ways to pay your taxes.

How far back can the IRS collect unpaid taxes.

Can The Irs Garnish Your Pension Or Retirement Account Community Tax

Filing Back Taxes What To Know Credit Karma Tax

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

Can The Irs Take Or Hold My Refund Yes H R Block

How Far Back Can The Irs Audit You New 2022

How Long Can The Irs Attempt To Collect Unpaid Taxes Irs Collection Statute Expiration Date Youtube

Tax Liens Fighting Irs And State Tax Collections

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

How Far Back Can The Irs Audit Polston Tax

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

I Owe The Irs Back Taxes Help J M Sells Law Ltd

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Tax Levy Understanding The Tax Levy A 15 Minute Guide

How Far Back Can The Irs Audit Your Tax Returns

Owing Back Taxes And Disablity

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Owing Back Taxes And Disablity

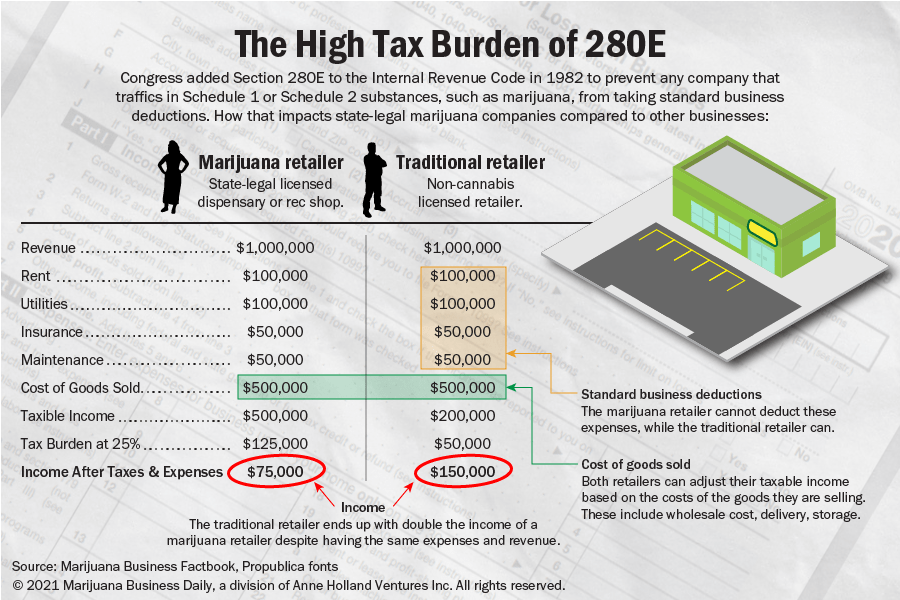

Newly Released Irs Documents Detail Effort To Collect Taxes From Marijuana Companies Under 280e